Commissions Overview

The system allows you to set up and process various levels of salespersons and their respective commissions based upon these levels. It is possible to apply various commission rates to each salesperson, at each level, with this function. Additionally, commission payments can be calculated on partial as well as full invoice payments.

Hierarchical Structure

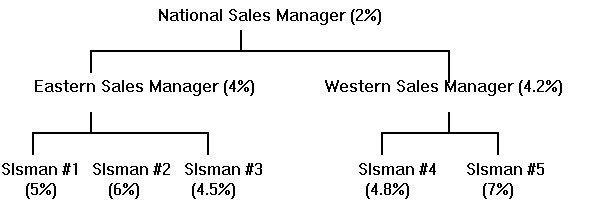

To process commissions using a hierarchical structure, you should understand the structure involved. For example, the following diagram shows a typical salesperson/commission structure.

This diagram shows that the National Sales Manager receives 2% of all invoices generated, the Eastern Sales Manager receives 4% of all invoices generated by the salespersons whom he manages, and the Western Sales Manager receives 4.2% of invoices generated by the salespersons whom he manages. Each of the salespersons receives the indicated percentage of commission.

Processing and Calculating Commissions

After you have set up all forms used for calculating commissions, the system is ready to process commissions. After customer invoices are posted, the system follows the following rules to calculate the commission amounts due:

When the invoice is posted:

- If the Commission Due on Payment check box is selected on the Order Entry Parameters form, the system generates commissions due records only when customer orders are invoiced, and based on what the customer actually pays.

- If Commission Due on Payment check box is cleared, the total commission amount due is recorded at this time.

When payment is received from the customer, the system calculates the commission due each salesperson for each invoice as follows:

- The percentage paid of the total invoice is calculated using this

formula: PP = AP / IT. This allows commissions to be calculated on

partial payment of invoices, where.

PP = Percentage Paid

AP = Amount of Payment

IT = Invoice Total

- The percentage of commission due to each salesperson is determined

using the following formula: PCD = PPI * SCP.

PCD = Percentage of Commission Due

PPI = Percentage Paid of Invoice

SCP = Salesperson's Commission percent

- The commission amount due to each salesperson is determined using

this formula: CAD = PCD * IT

CAD = Commission Amount Due

PCD = Percentage of Commission

IT = Invoice Total

Because the system allows various levels of salespersons, a special process is followed to create the commission due listed above for each salesperson. In order to process the commission due, the commissions function performs these steps, in order:

- The system refers to the Salespersons form for the salesperson listed on the invoice and calculates the percentage and commission due to that salesperson (as shown above).

- Next, the system refers to the Sales Manager field in the Salespersons form, and calculates the percentage due for the sales manager (if the Sales Manager field contains a salesperson's initials.)

- If a number exists in the Sales Manager field of the Salespersons form, the commission is calculated for that manager.

This process continues higher up the chain of command until a blank Sales Manager field is encountered. This allows commission payments to be given to a salesperson, as well as all managers higher in the hierarchy for any invoice.

Commission Distributions for an Order

Use the Salesperson Commission Distribution form to assign multiple sales representatives to a single customer order or line item. A sales commission record is generated for each distribution that you enter.

Any commission amount that you specify with a blank sequence or line number is applied to all lines of the order. If, in addition to this blank sequence record, you add a record for a specific line of the order, both commission rates are applied to that line.

Commissions to Employees

Salespersons who are considered employees of the company (indicated by the Outside check box being cleared on the Salespersons form) are paid commissions based upon their Employees record. When payroll is processed and it is time to pay the salesperson, depending on whether the salesperson is paid biweekly, weekly, monthly, or whatever, the commissions are totaled and paid.

When the Salespersons file is set up, the Deductions & Earnings Code under which the commissions are reported is recorded for each salesperson. When payroll is generated, the system selects all commission due records that contain information relating to the invoice number, salesperson, and commission amount due for each customer payment processed.

The system then totals these records, and displays the total commission paid in the specified Deductions & Earnings Code field indicated for each salesperson. This commission amount is paid when payroll checks are printed.

Commissions to Vendors

Salespersons who are not considered employees of the company (indicated by the Outside check box on the Salespersons form being selected) are paid commission when accounts payable payment processing occurs. This type of salesperson is paid when a commission becomes due (meaning, a Commissions Due record has been created) and payments are processed through Accounts Payable.

Processing commissions for these salespersons works the same as for employees of the company. The system looks at commission due records for the salesperson (vendor), calculates the total commission due to the salesperson, and that amount is then paid when disbursements are generated.

Commissions Due

Commission due records are not deleted when commissions are paid, but rather are marked as paid. Therefore, by using the Commissions Due form, you can adjust commissions that are due.

Altering Calculation Methods

Currently, commission percents are calculated both by salesperson and product code, as defined in the Commission Table Maintenance form. However, the commission calculations may be customized to fit the needs of the company.